Understand how to craft financials into your pitch deck to secure investor funding for your startup.

There are 4 main components of business that make a startup investible:

This article will focus on what investors look for in a startup’s financial projections, and how startups can craft their financial assumptions and ask to secure investor funding.

For pitch purposes, financial modeling can be simplified into methodology and assumptions, which sum into results. Methodology involves generally accepted accounting principles, which are immutable accounting facts and figures. Assumptions, contrarily, are estimates, targets, or milestones that investors look at to discern a team’s processes before providing funding. Haphazardly assembling financials appear like guesswork and deter investors, but logical and thorough financial assumptions can win investor commitments.

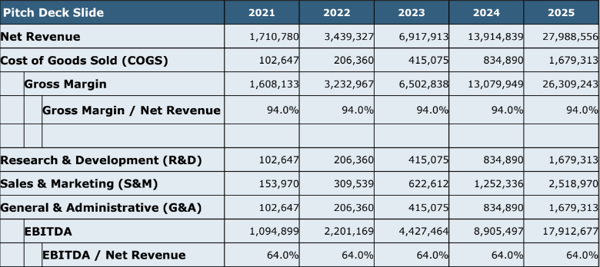

A pitch deck slide on financials should be clear and concise, with the following categories:

Evaluating a startup is holistic: depending on a company’s specific situation, each of these categories can be broken down into multiple line items, or represent one line item. Regardless of your startup’s situation, financial projections should support a story that you are pitching to investors.

Usually, the first line on a pitch deck’s financial slide is the revenue, which drives all projections. Factors that drive revenue include price per unit of your startup’s product or service, volume or units sold, and the net growth. In the startup stage, numbers such as price per unit and the units sold are all estimates, but they need to be backed by market research. For example, to find price per unit, a startup would need to look at their competition and talk to potential customers about what price they are willing to pay. For volume, a startup needs to consider the manufacturability of a product, and the feasibility of manufacturing a certain volume given limited resources.

The biggest revenue assumption is net growth. Because there are many business models that rely on subscription customers, startups must consider churn rate - or the retention of subscribers - when breaking down revenue streams.

Since revenue often comes from multiple sources, the more a startup can dissect its revenue streams, the better they look to investors. Revenue streams can come from multiple product lines or geographic markets. Clearly explaining your company’s revenue streams allows investors to come up with a precise valuation of your company.

Revenue drives expenses, or costs, which should be included in the after revenue in a financial projections table. Costs include the cost of goods sold (COGS), operating expenses (Research & Development [R&D], Sales & Marketing [S&M], and General & Administrative [G&A]), and long term assets (such as property, plant, and equipment and intellectual property). There should be individual line items for each of the operating expenses (R&D, S&M, G&A), as well as long term assets.

If your startup sells products, there should be a line item for COGS under the revenue. Oftentimes, you may not know exactly what the COGS will be, but you can make a reasonable estimate by looking at the competition and evaluating what price point your customers will be willing to pay. Putting any number that doesn’t make sense for COGS will show investors that the team didn’t do their preliminary research, making the startup more risky to invest in.

Another risk that investors look for is marketing expenses related to market shaping. Compared to products that users are familiar with, new or novel innovations need to be accepted by consumers, thus forcing higher upfront marketing costs. Accounting for these costs in your financial projections will de-risk your startup for investors. Marketing expenses can go into a variety of streams, including public relations, publicity, trade shows, and third-party marketing (such as influencers).

G&A costs help investors evaluate a company’s progress and usage of funds. Investors keep their eyes peeled for cash burn, or the monthly spending before and after securing funding. Companies that see significant changes in spending after receiving funding, or with executives that pay themselves high salaries but deliver little results over the years, raise red flags. It may help to add a line item near the bottom of your financial projections detailing previous and projected G&A costs, which would include the number of employees and their salaries.

Here is a sample pitch deck slide, with a bare bones outline of how financial projections can look:

As you can see, this financial projection covers 5 years. It is recommended to have 5 years on your financial projections. Depending on what narrative your startup wants to convey, the line items can be manipulated. For example, your startup can choose to input gross revenue, so investors can compare revenue to R&D or S&M, to show if you are spending more or less than competitors in your area.

Once you have established your company’s financials, it's time for your company's formal ask.

Part of a pitch’s ask will be the startup’s valuation, which is driven by revenue growth, risk, and competition. Valuation is influenced by a multitude of factors, so there is no one number you can plug into a formula and have an objective answer. Instead, valuation should be treated as a negotiation because it has to be fair for both the investor and the company.

A mistake that startups make is to value their company at their future cash flow by simply multiplying EBITDA and disregarding risk. However, when investors value companies, they look at factors like traction and growth, how realistic the company’s assumptions are, and risk.

Venture capitalists can create a baseline value of your company by looking at a company’s trailing twelve months, competing products and businesses’ value, traction, and intellectual property. From this baseline, they will add or subtract value based on other assumptions such as exit potential.

Basing your valuation on the same factors that investors consider can bring your company valuation closer to a VC’s valuation of your startup. To value your startup, you can look at competition, or use the Berkus Method of Valuation. The Berkus Method assigns a value to five qualitative value-drivers of a company - the business model, prototype, executive ability, strategic relationships, and existing customers.

More recently, investors have seen increases in startup valuation. Whereas previously, a startup would usually be valued around $3 million, now investors see startups with valuations up to $15 or $20 million. Factors that lead to higher valuations include:

🔬 Read about: Valuing Your Early Stage Biotech Company

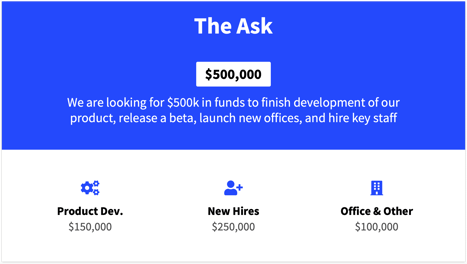

Here is an example of the information you may have on your ask slide:

The ask should include existing investors (prior investors and the amount of money the founders put into the company), the amount being requested, and the form of which it is requested.

A startup has many options for the type of funding to request in the seed round. No matter which funding option you choose, it must be realistically specified in the ask slide. Some investors gravitate towards preferred shares, but each investor and situation is different. Depending on the context, using convertible notes, or another form of funding, can have advantages over preferred shares. For example, convertible notes have caps, which act as a proxy for the next financing round - investors either get a 20% discount off the next round, or the cap.

🔬 Related: Unconventional Funding Sources for Biotech and Medtech Startups

Following your ask, you will need a slide in your pitch deck to articulate how your company will be allocating funding based on financial needs. The most common method to convey this information is a high-level overview of spending - this could be in a pie chart or a table, or another method. Investors are looking for how you will be allocating resources.

A big section is S&M - if your startup has built a case for high spending in S&M, it should take a large portion of funding in the use of funds section. It may be helpful to add a further breakdown of anticipated S&M spending in the appendix.

🔬 Read: Marketing Your Startup Business for Explosive Growth

Generally, a pitch deck should include a 5 year projection, followed by an ask, and finally a use of funds slide.

A pitch deck’s financials and ask should be clean and only include the most important categories. However, to be prepared for your pitch, you should consider information that may be asked during the Q&A session - such as a 5-month marketing plan or employee salaries. Some question topics to consider regarding financials include sales activities and metrics, customer acquisition cost (CAC), and salaries and wages.

You may choose to address these questions by adding and referring to slides in the appendix, or be able to answer based on your knowledge of your company. It is important to have due diligence for accurate and thorough financials. During a pitch, financials will be a brief overview, but interested investors will examine each statement with a team of financial experts after the pitch during due diligence. They look closely at each section to ensure the startup seeking funding is trustworthy and can make money for them - so even though you may not include monthly financial breakdowns in your pitch deck, you should have them readily available in case investors request them.

In the end, the pitch deck is yours - there is no one way to put together a pitch deck, nor is there a formula. Each pitch deck should be tailored to the audience; financial slides should be tailored to individual circumstances.

🔬 Learn: Six Common Mistakes in Biotech Pitch Decks

This article comes from a 4-part webinar series, hosted by University Lab Partners in conjunction with theSBDC @ UCI Beall Applied Innovation. Laura Beckan is a business consultant with the SBDC. Guest speaker David Friedman is a business consultant and angel investor who has invested in several companies in technology, biopharmaceuticals, and medical devices.

📽️ Watch the full webinar here.

Be sure to subscribe to the ULP YouTube Channel to never miss another webinar, and connect with us on LinkedIn to stay in the loop!

Download The Ultimate Guide to Wet Lab Incubators in Southern California, a handbook to assist life science start-ups through the entire decision-making process to find wet lab space.

Download Now