How to understand market opportunity and competition in terms that investors use, such as TAM/SAM/SOM, and go-to-market strategy.

Market size is an aspect of your startup that you have limited control over. That being said, it is one of the most important factors when investors are looking to invest in your product or service. If the market is not big enough, there is no opportunity to make a high enough return for investors, no matter the product.

🔬 Learn about: Funding Options for Biotech Startups

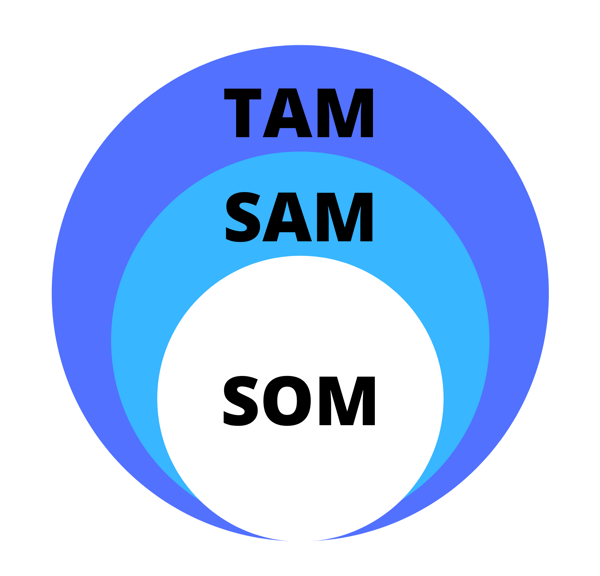

There are three main ways to convey market size/opportunity to investors: TAM, SAM, SOM. TAM stands for total addressable market, SAM stands for serviceable addressable market, and SOM stands for serviceable obtainable market.

TAM is the most universal way to convey market size, usually meaning the industry level market size. In other words, TAM is the overall revenue opportunity that is available to a product/service if 100% of the market share was achieved. Of course, it is almost impossible to achieve 100% market share, but this number gives a good estimate for investors to see what type of industry they would be investing in.

After finding your TAM, you will need to narrow it down into your SAM. SAM is the revenue for the customer segment that is the best fit for your product. You could also think of it as everyone who should buy your product (but not necessarily will).

Finally, you will need to narrow down your SAM into your SOM. Your SOM is your niche market, or everyone that would buy your product. The SOM will be the smallest number, but is the most important to potential investors because it gives them an accurate idea of your specific market.

There are two main ways to calculate market sizes: top down and bottom up. Bottom up is most often used for SOM, as investors want the most accurate number possible, as opposed to simply a percentage of TAM or SAM. One of the main challenges that comes with calculating SOM is finding data for the calculations. The largest and most common mistakes come from overstating industry size.

For this article, we will use a made-up product, self-cleaning diapers, as a running example. In order to calculate TAM/SAM/SOM for these self cleaning diapers using the top down approach, you might look for:

The bottom up approach uses your specific pricing, and attempts to find market size by multiplying. For example:

This generally requires more demographic data, and it also requires you to have your prices and manufacturing already known. For example, if your calculated SOM is 300 diapers, but your factory can only produce 200 diapers, your real SOM will be 200.

🔬 Look into: A Deeper Dive into Market Segmentation

Investors commonly ask for your go to market plan. This requires you to specifically articulate the marketing and sales channels you need to get your product/service to the market. It does not mean the list of things you need to do before getting your product to the market (creating apps, getting IP, etc).

When describing go-to-market, you need to imagine that you already have your product/service finalized and you have already identified your SOM. Go-to-market describes how you will get there, or how you will reach that specific segment of the population. For example, you might need to hire salespeople, attend events, or hire a marketing firm in order to get the word out about your product. This information is important to investors as it lets them know that once the product is finished, you have already thought through the steps of getting real sales.

Now that you know what go-to-market means, you need to determine your company’s plan for success. The first step is to determine whether you will operate B2B (Business to Business) or B2C (Business to Consumer). B2C typically requires more marketing dollars, as it requires you to go out and find your consumers directly. B2C becomes easier as your market segment (SOM) becomes smaller, as it is easier to find potential customers. Because of this, investors typically prefer B2B businesses, as they often have more established sales methods and channels.

🔬 Related: Implementing Voice of Customer (VOC) in Your Business

Next you will want to consider the competition you will encounter when you get to market. Your competition does not have to be an existing product similar to yours. Your competition could also be the way that consumers are getting the job done now (without any product/service).

Investors want to know that you understand your potential competition, and an easy way to articulate this is with a competition matrix. See the graphic below for an example.

This is the most common way to present a competition matrix, with benefits on the left and your competition on top. It is important to note that benefits are not the product's features. For example, “5 buttons” is not a benefit. Instead, a benefit could be that the product is simple to understand/use because of the limited buttons. Usually, benefits will be listed in order of importance, with Benefit #1 being the most attractive benefit of the product.

Finally, you will need to find how you are going to reach your customer base. Your method will depend on whether you are B2B or B2C, but here are some of the most common strategy examples:

After determining the marketing/sales strategy that works for your company, you will want to calculate some metrics to present to investors. These can include:

These metrics inform investors on the nature of your sales, but they can also help inform your management team on how to best improve your business.

Finding your market size and understanding how to go-to-market is an important part of any business’s pitch deck for investors. Knowing exactly who your customer is, and how you will get to them, makes going to market much easier.

How to Create a Value Proposition to Attract Investors

The Importance of Market Research in Biotech and Medtech Startups

4 Key Types of Market Segmentation: Everything You Need to Know

This content comes from a webinar, Creating an Investable Startup: The Market - Part 2 of 4, featuring Laura Beken and Kayvan Baroumand in partnership with the SBDC @ UCI Beall Applied Innovation and University Lab Partners.

📽️ Watch the full webinar here.

Be sure to subscribe to the ULP YouTube Channel to never miss another webinar, and connect with us on LinkedIn to stay in the loop!

Download The Ultimate Guide to Wet Lab Incubators in Southern California, a handbook to assist life science start-ups through the entire decision-making process to find wet lab space.

Download Now