It’s easy for researchers to get invested in the research portion of what may potentially become a business. However, when it’s time to make the transition from lab to board room, it’s not always easy for bioresearch or medtech startups to make that switch. There’s quite a bit to be considered and, among those is financing. For entrepreneurs, even in the life sciences industry, to be successful, they need a solid business plan.

Creating a polished and thorough business plan for your bioresearch or medtech startup is a great way to outline your goals and desires as a new business owner and to communicate those goals to potential investors.

A business plan is a document that outlines various facets of your new business. Many new business owners look at a business plan as a necessary evil, or a means to an end. It is often the first thing an investor will ask for if they are interested in your company. Instead of thinking of it as an assignment, you should strive to see your business plan as a research endeavor.

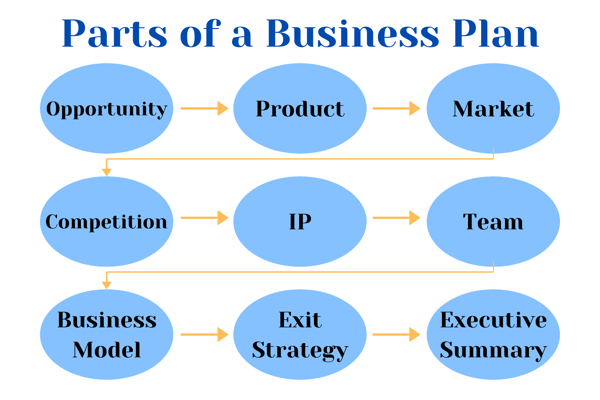

There are certain aspects of your company you should include in your business plan including:

The Opportunity

The Product

The Market

The Competition

The IP

The Team

The Business Model

The Exit Strategy

The Executive Summary

We’ll review each of these in detail , But bear in mind, substance and methods will be different for each company. Still, a business plan is a business plan and whether you’re a bioresearch or medtech startup or something completely different, this formula can be adapted for your startup!

Why Does a Bioresearch or Medtech Startup Need a Business Plan?

Let’s start here: a business is a business, regardless of the industry and business plans have both an internal and external value for your company.

Internally, there are many values. It allows you to have a solid plan to move a team forward quickly and easily communicate your priorities. A business plan should also have a Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis built in.

An existing business plan will also help you to easily integrate new personnel because your goals and vision has already been laid out and written down. Most importantly, a business plan can let you measure your performance in relation to the goals you set when you first completed the plan. Externally, the main value is that business plans are a vehicle to attract and solidify relationships with investors or potential partners.

Here are some things a business plan should do:

Clearly defining and stating these objectives can contribute positively to your growth and development as a company. But, just writing down your observations and plan will not get the job done. You need to constantly revisit your business plan and integrate it into your daily goals.

There is no magic formula for a business plan, but we’ll go over some of the key sections you should include, particularly if presenting the document to potential investors or funders. Usually, a traditional evaluation is sufficient for many investors and for internal use. However, it’s important to remember that the quality of your business plan, and the effort you put into it can show evidence of a sound business opportunity, a clear path, and some financial benefit for the investor.

.png?width=600&name=Untitled%20design%20(1).png)

As we wouldn’t sit down to write a research report without investing time in the actual research, the same holds true for your business plan. Planning ahead, asking some tough questions, and researching the marketplace are all crucial to developing a solid business plan.

Here are some of the questions you’ll want to consider when drafting a business plan:

Keeping these questions and their answers in mind is essential for creating your plan. This will enable you to better describe your company and its goals. Now, we can get into each section of the business plan and detail what should be included.

Many investors will read the executive summary before they read a company's entire business plan. Therefore, the executive summary must entice the reader to ask for more information and finish reading the entire plan. It should discuss the opportunity, product, technology, market, competition, IP, business model, team, and exit strategy in ONE or TWO pages. So, essentially, it's a summary of the entire business plan. This is why you need to write it last, so you are able to summarize what you have already written.

Open your business plan with an introduction including a short summary of what your company will do and what products you plan to produce.

In addition to that summary, you should also include a company vision statement. Vision statements are one or two sentences that all your employees know and can repeat to others, like a long tagline. Your introduction should also include your mission statement. A mission statement should elegantly present the company's vision. It should not be too rosy or overly optimistic.

The opportunity section discusses the reasons for starting the company and why it can succeed. The primary question for this section is: how will the company generate a significant profit? To answer that larger question, you will need to answer most (or all) of these questions:

If (and only if) your investor is not familiar with biotech or medtech startups, it may be pertinent to outline some of the broader aspects of the field. This could include details on healthcare reform, FDA approvals, and more. But, if your investor is knowledgeable about biotechnology, that might not be necessary.

In this section you’ll describe, in enough detail, your technology so experts will “get it” and appreciate how it works. Here are some things to remember for your technology section:

The Intellectual Property (IP) section should summarize how the company will protect and develop their IP. When writing the IP section of a biotech business plan, you should consider these questions:

If your company does not have any IP, you will need to describe your licensing strategy. This will show that your company will not be blocked or hindered in operation from another patent. If you are a spin out from a university, licensing is usually easier. This is because the university and your company can benefit from licensing. But, it is important to do extensive research for your particular situation. Learn more about securing IP for your startup here.

In the competition section, you will want to provide a profile of all significant competing companies. This will require extensive research, but it is better to include all options than to leave any out. Consider these questions when drafting your competition section:

Lots of these questions are hypothetical, but thinking about their possible outcomes is important to understanding your competition. Being forthright with investors is a better idea than downplaying possible competition in the market. Further, investors will also do their own research and if they uncover competitors you don’t mention, it may impact their willingness to invest.

Another important thing to consider is the “status quo.” If there truly is no other company in your market that could be competition, your competition will be the current status quo. Why should consumers use your product over what they are currently doing?

There's an old adage that says “Investors don't invest in ideas, they invest in people.” In this section, you want to be able to market yourself and your colleagues. What qualifications of your management team can help you achieve your goals?

You should try to focus on business leadership and scientific or technical expertise. It shouldn't be only business-centered team members or only scientific center team members. The key is balance. You should also include a very short biography of the management team, scientific advisors, and directors. For additional and more specific information, you can add each of their resumes in the appendix.

This section describes how you expect to make money selling your product. For a biotech company, money is often a long way down the road. Creating a business model early on will allow you to understand where your money is coming from before you make a profit. You will need to consider these questions when formulating your business model (different from a business plan):

The financial section is used to document, justify, and convince your investors to give you money.

Many business plans will include overly optimistic revenue projections while claiming they are conservative. Avoiding this is essential because, again, investors often conduct their own research, and they do not want to see overprojections. Most investors have little faith in rosy revenue projections.

One great way to establish credibility is through what’s called comparables. Comparables are companies similar to yours that you can use to describe (and project) your growth and expenses. This section should also include a balance sheet, income, and cash flow statements.

Unless someone on your team is a CPA or has an MBA degree, it is smart to hire outside help for the financial part of your business plan. This way you can be entirely sure that your findings are correct, and that investors will not question your credibility.

This part of the business plan discusses when the company should be sold or go public. This is a hard and complex topic to unpack. To better understand this section, put yourself in an investor's shoes and imagine how you might feel if there is no plan and, potentially, limited or no return on the investment.

When creating an exit strategy, you should try to avoid comparisons to exceptions. Instead, compare your company's exit to what a similar company has done or will do.

Every section of a business plan will represent a potential source of risk. Your business plan should do everything it can to minimize the perceived risk of your company. Again, this is where a SWOT analysis can come in incredibly useful. In areas where risk is high, you should try to discuss contingencies,and remember, the biggest risk is not having a business plan ready when an investor asks for yours!

Your business plan is the first step in seeing your bioresearch or medtech startup come to fruition, so putting your best foot forward is essential. That means putting together a well thought out, detailed, and researched business plan. Learning how to write a business plan is an early investment in your business, so seeking opportunities for more information and feedback from others is invaluable.

We’ve included a few FAQs, below, that can help you along the way!

Q: Why is it important for the vision statement in the introduction to be something everyone in your organization knows?

A: It's a way for all of the employees to have the same response to a question like: What does your company do? It is often more than just a tagline, but less than a mission statement.

Q: What types of exercises should you do when you're thinking about starting a company?

A: A great exercise to do is a SWOT analysis. This can allow you to understand whether or not your idea can become an actual business or not.

Q: Will licensing (instead of owning your own IP) scare away investors?

A: In short, no. As long as you can get a license or create a deal with the owner, the investor should be okay with it. However, you will need to do research in order to ensure that this is possible.

Q: How can you ensure your financial section will be acceptable for an investor?

A: Develop the business model, the comparables, and use them as a basis for your projections. As noted above, consult with financial advisors, CPAs, and others who can provide financial and business expertise.

Q: Where can I find an example of a business plan?

A: Google is a great resource. A quick search for “biotech business plan examples” will deliver plenty of options for inspiration.

This content comes from a University Lab Partners webinar hosted in partnership with ScienceDocs featuring Dr. John Bilello, consultant with ScienceDocs.

ScienceDocs is a U.S. based, comprehensive scientific and medical research support provider that has been leading the industry since 2004.

Dr. Bilello is a Ph.D. in Molecular Biology and was the former Director of Technology Development at GlaxoSmithKline. In addition to an established track record of innovative basic and clinical research, Dr. Bilello has experience in both project and organizational management.

Be sure to subscribe to the ULP Youtube Channel to never miss another webinar, and connect with us on LinkedIn to stay in the loop!

Revised 01/02/2024

Download The Ultimate Guide to Wet Lab Incubators in Southern California, a handbook to assist life science start-ups through the entire decision-making process to find wet lab space.

Download Now