There are 4 main types of resources available for small businesses.

Are you looking to find funding for your biotech startup in order to continue research and further your product development? Today, there are many resources available for small businesses that you can use to fund your company. The 4 main types are organic sales, equity investments, federal funding, and corporate partnerships. Each of these types are detailed below; assessing which type of funding is best for your company will help you grow and prosper.

Another thing to remember is that most small businesses use a combination of all 4 of the main types of funding. Startups can not survive for long on just SBIR grants (or any of the 4), especially in the biotech industry. Usually, the best strategy is to diversity your funding sources.

🔬Read: Funding Options for BioTech Startups to learn more about different sources of capital.

The first thing to understand is that in order to fund a biotech company you will need A LOT of time and money. Finding funding for a biotech startup is a process that continues for many years. This applies to all biotech companies, no matter what product or service you plan to sell. For developing a new drug, it is likely that you will need around 2.5 billion dollars and around 10-15 years of work for the drug to be ready for market. For medical devices, it depends on what class of device you plan to sell. Class II devices with 510(k) will take around 31 months and around $31 million dollars. Class III devices usually take around 54 months after initial FDA discussions and around $94 million (these numbers do NOT include costs of failures and cost of capital).

Organic growth funding is most common when you are dealing with non-FDA products. This includes research tools that you will sell to people in academia or in the research industry. Sometimes, a company is able to prove their customer and their margins as they go with a “sell as you go” strategy. This allows you to retain full ownership of your company, but this method is only appropriate for certain types of products and services. The problem with relying solely on organic sales/growth is that you are constantly at risk of lack of capital. This creates a ‘chicken and the egg’ paradox. How will you pay others (personel or manufacturing) if you can’t expand sales? How will you expand sales if you can’t afford to bring on more people or expand manufacturing?

Another type of funding is equity investments. This means that you will trade ownership of your company for cash from investors. In order to do this you need to convince others that you and your company are a reliable investment; you need good sales skills and a realistic business plan. There are 2 major types of equity investments: venture capital investors and angel investors.

Venture capital firms gather money from wealthy individuals and financial institutions and create a large fund. These funds normally have a beginning and an end, usually 10 years with the first 5 years having active investments in new portfolio companies.

The Tech Coast Angels are a widely-known Southern California Angel firm.

The other type of equity investors are angel investors. As opposed to venture capital funding, angel investors are individual investors and therefore make individual investment decisions. Sometimes angels will form groups in order to streamline their due diligence and provide efficiency. A notable local group is called the Tech Coast Angels. Despite the group atmosphere, you still need to convince individuals, one by one, to invest in your company.

The third major type of biotech funding is from the federal government, specifically in Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) awards. There are many awards for biotech businesses at the federal level but these two are specifically given to small businesses. SBIR and STTR grants are not 'finding funding' for your biotech startup but instead are applying for funding. These awards are very competitive; around 10%-20% of funding applications are granted at the Phase I level. Funding for these awards will come in phases, the first being around $100k - 400k. Phase II is reserved for ‘commercialization ready products’ and typically is awarded $750k to $2 million. Agencies typically take around 3-5 months until a clear decision is made about your SBIR/STTR application, and another 3-4 months until you are actually awarded the money.

The SBDC at UCI Beall Applied Innovation provides free consulting to small businesses in the Orange County area and can help with SBIR/STTR applications.

If you are considering applying for an SBIR/STTR grant for your startup, check out this article on how incubators could potentially improve your application.

The last type of small business funding is using corporate partnerships, a type of funding that is often forgotten. Large companies have the money to give away and are seeking out innovation to better themselves. The best way to approach this is to evaluate your and your corporate partner’s strengths to see how you can get the most out of your relationship. This relationship varies with each project, and the amount of work done by both parties can vary greatly. Something that is very important to remember is the protection of both company’s intellectual property (IP). The deal structure needs to indicate protection of pre-existing and newly-created IP for both companies.

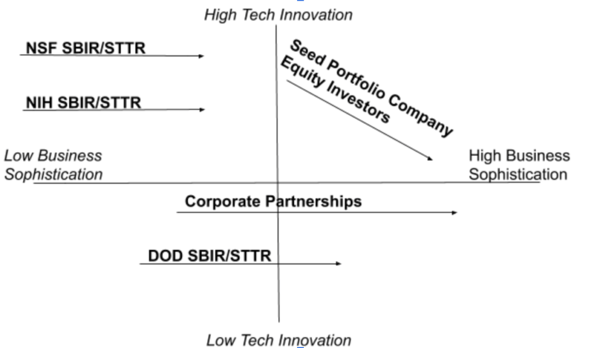

Now you know the 4 main types of funding opportunities for small businesses. Next, you need to evaluate each and decide which is, or which combination, is best for you and your company. Building your business while keeping in mind the best ways to get funding will allow you to access the most amount of funding types. Below is a graph with two axis: Business Sophistication and Tech Innovation. A successful company can exist anywhere on this graph except for the bottom left. Recognizing where your company realistically falls can help you decide which type of funding is best for you

This chart is a rough gauge of the different types of funding and the typical companies that seek them out. Do your own research to find out which is best for you!

Investors are feeling uneasy and unconfident with their money right now. You should expect investors to be a little more conservative and give decreased valuations. A deceased valuation will affect the amount of money that you can make in the long run. As of now, life science companies are focusing mainly on COVID-19 related technology and practices. This means that corporate partnerships in other fields that are unrelated to the pandemic will likely diminish.

Despite the pandemic and limiting corporate partnerships, companies are still able to succeed. In order to stay afloat in these tremulous times company owners and executives should keep a few things in mind. First: stay focused. Now that cash is limited you want to make sure that you are focusing all of your effort and man power on your best idea. Second: know where you are going. You need to set a clear goal and determine exactly what you need to obtain it. Knowing what you want and how you can get there are important parts of growing your company.

How much money should I personally have invested in my company before I go to investors?

This is a tough question because each individual and business has its own unique circumstances. Investors don’t expect or need to see each small business owner pour their life savings into their work. Instead, they want to see that, at the very least, you are willing to back up your work with a small part of your own money. If investors ask why you haven’t invested much personal money, be honest.

Is there an agency that facilitates matchmaking between startups and companies for partnerships?

There are certainly individuals who can help you, typically business development consultants. These people can be valuable especially if you do not have many connections in the industry.

What about charitable foundations as a source of funding?

Charitable foundations are most helpful if your product or drug is addressing a particular disease that has a charitable foundation fighting to cure it. Some examples of helpful foundations are the Juvenile Diabetes and the Cystic Fibrosis Foundations. These groups help bring many new medications to the market.

How do you protect your IP if an investor is doing due diligence on your company?

Don’t be secretive about your vital IP, but do save it for last. Many times the actual investors don’t need to know exactly what your IP is, only the IP attorneys do.

What are some major VCs or Angels in the Orange County area?

Some of the major Angels groups include Tech Coast Angels, Pasadena Angels, and individual high net-worth angels. Angels usually invest in regional companies. Beall Applied innovation has some great connections to venture capital groups in the area, the first step is to contact the SBDC or UCI Beall directly. Make sure you have your pitch deck ready!

In a corporate partnership who usually owns the IP?

This depends completely on your negotiation. Either the small company or the larger partner could both own it depending on the deal they reach. Usually small companies will keep their IP unless it is needed to sell a particular product; in that case they will license it out to sell that product.

Can the SBDC help companies with federal grant writing?

Generally, the SBDC will ‘advise but not do’. They will not write or submit, but they will help you do so yourself. The agencies that you submit your SBIR/STTR applications make it as easy as they can for you to submit your proposal.

Should companies continue to focus on SBIR/STTR funding or should they just take what they can get now that they are in ‘survival mode’ from COVID-19?

If you are a tech-strong company, it is always encouraged to look toward SBIR and STTR awards because they create a technical seal of approval for investors. In this current environment however, it is important to reassess every aspect of your business and how the pandemic will affect your company.

This content comes from a webinar on how to find funding for your biotech startup from University Lab Partners and the SBDC at UCI Beall Applied Innovation featuring Dr. Molly Schmid. Molly is an expert in Life Science Technology and Commercialization. She is the Senior Consultant at SBDC at UCI Beall Applied Innovation Center specializing in high potential SoCal startups, biotech startups, and all companies seeking SBIR or STTR funding.

If you want to learn more about building startups, check out this article from ULP about building your brand and if you would like to access the full webinar, check out the University Lab Partners Youtube Channel.

Connect with us on LinkedIn in order to receive daily updates and ULP news.

Download The Ultimate Guide to Wet Lab Incubators in Southern California, a handbook to assist life science start-ups through the entire decision-making process to find wet lab space.

Download Now